SECTION A – GENERAL TERMS

Introduction and Overview

Thank you for choosing Intuit Inc. We provide a platform (the “Platform”) that encompasses (1) a variety of services, including TurboTax and QuickBooks (each, a “Service”); and (2) installable software (including our desktop and mobile applications), any accompanying documentation, and any updates to such software or documentation (collectively, “Software”). Intuit Inc., along with any parent, subsidiary, affiliate, or related companies (including those listed here and at https://www.intuit.com/legal/intuit-group-companies/) are referred to in these provisions as “Intuit Group Companies” or simply “Intuit” or “us.”

When you use the Platform, you enter into a binding contract with us. Each section of the agreement begins with an italicized annotation that is intended to help you navigate the agreement. The annotations do not completely summarize the agreement, though, and you should read each section carefully and in full. We’ve also bolded a few areas that talk about important legal rights, and you should be sure to read those sections carefully. These provisions in Section A apply to the Platform generally and are separate from the provisions in Section B which include additional provisions for your use of specific Intuit Software or Services (as defined below).

If you are an individual acting on your company’s or client’s behalf, you accept these provisions on their behalf and the term “you” will refer to you, your company, or your client.

Agreement to These Terms

You need to agree to these terms to use our Platform. By using the Platform, you are instructing us to share your data across our Platform for marketing, eligibility, and other purposes described in our Global Privacy Statement, consistent with applicable law. This data may include credit information and other information we obtain from third parties.

To access and/or use the Platform, you acknowledge and agree:

- To the terms and conditions of this agreement (“Agreement”), which includes:

- Intuit’s Global Privacy Statement;

- The current version of the terms set out in Section A and Section B; and

- Any additional provisions and conditions provided separately to you for your use of the Platform, which may include terms and conditions from third parties (which we refer to as “Additional Terms”)

- You are at least 18 years of age;

- You are capable of forming a binding contract with Intuit; and

- You are not a person who is prohibited from using the Platform under the laws of the United States, or any other applicable jurisdiction.

You understand that by using certain Services, you are providing written instructions in accordance with the Fair Credit Reporting Act and other applicable law to permit Intuit Inc. and its affiliated companies to obtain and periodically refresh your credit information and other information about you from third parties for marketing, eligibility, and other purposes described in Intuit’s Global Privacy Statement. You understand that your instructions authorize Intuit and its affiliated companies to obtain such information now and periodically in the future for as long as you have a registered Intuit account. We will stop refreshing your credit information when you cancel your account through your account settings.

Your Personal Information

We want to be transparent about how we use personal information and about your rights in our Global Privacy Statement. You should only provide us with personal information of others if you have received permission to do so. You agree that Intuit may use and maintain your personal information according to Intuit’s Global Privacy Statement and any changes published by Intuit.

To the extent we allow you to input personal information (as the term is defined under applicable law) about other individuals other than yourself, you represent and warrant that you have complied with all applicable laws and received the proper authority or consent to allow us to collect and process such information to operate our business, in accordance with our Global Privacy Statement. You further agree that, other than with respect to information furnished to TurboTax in connection with the preparation of an individual tax return, any sharing of personal information among Intuit Group Companies is contemplated as part of the Platform. You agree such sharing does not constitute a “sale” of information as defined under the CCPA.

Changes

Change happens. When it does happen, we will update this Agreement. If the changes are material, you may need to accept the changes to use the Platform. Similarly, there may be circumstances where we need to update or discontinue the Platform.

We may modify the provisions of this Agreement at any time. We may notify you of such modifications by posting through the Platform or on our website or by other means. It is important that you review this Agreement whenever we modify it because your continued use of the Platform indicates your agreement to the modifications.

In some cases, you may need to accept changes to this Agreement to continue using the Platform. If you do not agree to these changes, you may stop using the Platform or terminate your account.

Similarly, we may update the Platform, including with tools, utilities, improvements or third-party applications. You agree to receive these updates. We may further modify, suspend or discontinue parts of the Platform, including but not limited to the Software, at any time. You agree that we will not be liable to you or any third party for any modification, suspensions, or discontinuance of any part of the Platform.

Your rights to Use the Platform

You can use our Platform for your own personal, your own internal business and lawful use or as otherwise permitted under this Agreement.

Except as set forth in the Section B terms, you may access and use the Platform for your own internal, lawful purposes only, and only in accordance with the applicable terms provided by Intuit.

Beta Features

We may provide you with access to beta features in the Platform. You are free to use them, but they are provided as-is.

We may include new and/or updated pre-release and trial features in the Platform and such features are provided as-is. Your use of such features is at no additional cost but you must follow additional rules or restrictions that we may place on their use.

Account

You will provide accurate, up-to-date account information and securely manage such information.

You may need to sign up for an account to use the Platform. We may need to verify your identity, and you authorize us to collect information (e.g., date of birth, address) from you to do so (collectively, with all information requested to enable your account, “Account Information”). You will provide accurate, up-to-date Account Information, and we disclaim any liability arising from your failure to do so. Such failure may further limit your ability to use the Platform and affect the Platform’s accuracy and effectiveness.

You are responsible for securely managing your Account Information, including any password(s) for the Platform. You will notify us immediately if you believe that your Account Information or device you use to access the Platform has been lost or stolen or that someone is using your account without your permission.

Payment & Cancellations

Some Services may be free; others may have costs associated. For those with costs, we may charge your payment method for fees or on a subscription basis. You may cancel your subscription at any time but you may not receive a refund or partial refund.

We may require payment of fees or a subscription charge for use of the Platform (or certain portions of the Platform) and you agree to pay such fees. If you registered for a trial, you may need to purchase the Platform before the trial ends in order to retain access to any content provided to, or created through, the Platform.

Payments will be billed in U.S. dollars, and your account will be charged upon purchase and when you provide your payment information, unless stated otherwise in applicable payment provisions. If your payment information is not accurate, current, and complete, we may suspend or terminate your account. If you do not notify us of updates to your payment information, we may participate in programs supported by your card provider to try to update your payment information, and you authorize us to continue billing your account with the updated information that we obtain.

You may be charged a subscription fee in advance on an annual basis or other recurring interval disclosed to you prior to your purchase. For annual subscriptions, we will send you a reminder with the then-current subscription fee no less than thirty (30) days and no more than sixty (60) days before your subscription term ends, or otherwise as required by applicable law. Intuit may change the price for recurring subscription fees from time to time with notice to you. Price changes will take effect at the start of the next subscription period following the date of the price change. If you do not agree with the price change, you may unsubscribe prior to the price change going into effect.

Your payment to Intuit will automatically renew at the end of the applicable subscription period but you can cancel a subscription at any time. Unless otherwise indicated in your Subscription terms, Subscription cancellations will take effect the day after the last day of the current subscription period. If you cancel in the middle of a subscription period, you will be able to continue to access and use the applicable Service until the end of your subscription period. We do not provide refunds, partial refunds or credits for any cancellations or partial subscription period.

Desktop and Mobile App Use

Desktop and Mobile versions of our Platform may be available for download but you must follow applicable third-party platform, network or operating system terms when using them.

Access to the Platform and data or content residing on the Platform may be available through one or more apps for a compatible desktop computer or mobile device. You agree that you are solely responsible for any applicable changes, updates and fees as well as complying with the provisions of your agreement with your telecommunications network provider and any third-party mobile app marketplace.

With respect to the applicable Software, you are only granted limited rights to install and use the Software you have downloaded, signed up for a Subscription to use, or for which you have purchased a license or acquired a free trial license. Intuit reserves all other rights in the applicable Software not granted to you in writing in this Agreement. Conditioned upon your compliance with the terms and conditions of this Agreement (including all payment obligations) and any applicable, timely subscription payment(s), Intuit grants you a personal, limited, nonexclusive, nontransferable, revocable license to use the applicable Software only for the period of use provided in the ordering and activation terms (as applicable), as set forth in this Agreement or in Intuit’s then-current product discontinuation policies (as updated from time to time) and only for the purposes described by Intuit for the applicable Software.

You acknowledge and agree that such Software is licensed, not sold.

You may make a single copy of the Software for your own backup purposes provided that you reproduce on it all copyright and other proprietary notices that are on the original copy of the Software. You will not delete or in any manner alter the copyright, trademark and other proprietary rights notices or markings appearing on the Software as delivered to you.

Third Party Advice and Products

You may have access to professional advice and third-party products. Any such advice and products are not covered under this Agreement.

From time to time, we may offer specific functionality in the Platform that provides you with the opportunity to seek professional advice, for example, the ability to speak with a tax expert. Unless specifically disclosed, Intuit is not in the business of providing legal, financial, accounting, tax, health care, insurance, real estate or other professional service or advice, and you should consult with professionals for advice prior to making important decisions in these areas.

The Platform may include information about or offers for third-party services or products or allow you to access or connect your account to third-party services or products. Intuit does not warrant, and is not responsible for, the services and products or claims made about them, or the actions or inactions of any third party. You must review and comply with the third-party’s services and product provisions. Intuit may be compensated by those third parties, which could impact whether, how and where the services and products are displayed.

Content and Data

What’s yours remains yours, what’s ours remains ours, but we may use information you provide to improve our Platform.

You are solely responsible for anything you write, submit, receive, share and store or any data you input into the Platform (collectively, your “Content”). Content includes, but is not limited to, data, information, materials, text, graphics, images, audio, video that are uploaded, transmitted, posted, generated, stored, or otherwise made available through the Platform. You have no obligation to provide any content to the Platform, and you’re free to choose the content that you want to provide. You acknowledge certain functionality in the Platform may be dependent on the provision of Content and may not be available without such Content.

Your Content remains yours, which means that you retain any intellectual property rights that you have in your Content. By sharing your Content on the Platform, you hereby grant Intuit a license to use your Content, as described in more detail below.

1. What’s covered

This license covers your Content to the extent your Content is protected by intellectual property rights.

2. Scope

This license is:

- Worldwide, which means it’s valid anywhere in the world;

- Non-exclusive, which means you can license your Content to others; and

- Royalty-free, which means there are no fees for this license.

3. Rights

This license allows Intuit to:

- Host, reproduce, distribute, communicate, sublicense and use your Content — for example, to save your Content on our systems and make it accessible from anywhere you go;

- Publish or publicly display your Content, if you’ve made it visible to others; and

- Modify and create derivative works based on your Content, such as reformatting or translating it, and analyze your Content in order to train Intuit’s artificial intelligence and machine learning technologies.

4. Purpose

This license is for the limited purpose of operating, providing and improving the Platform, which includes, but it not limited to allowing the Platform to work as designed and creating new features, capabilities and functionalities.

5. Duration

This license lasts for as long as your Content is protected by intellectual property rights.

Intuit may collect, derive or generate deidentified and/or aggregated data regarding your usage of or the performance of the Platform, including data derived from your Content. Intuit will own all such data and may use this data without restriction, including, but not limited to, operating, analyzing, improving, or marketing Intuit’s products and services, including the Platform.

As between you and Intuit, Intuit and its licensors retain all right, title or interest in and to the Platform, except for the rights granted to you.

Prohibited Uses

We expect you to obey the law and follow certain rules in using the Platform.

Intuit does not condone or support any activity that is illegal, violates the rights of others, harms or damages Intuit’s reputation, or could cause Intuit to be liable to a third party. At minimum, you may not use the Platform to:

- Violate any law, regulation, executive order or ordinance, including through actions that give rise to criminal, civil, administrative or regulatory liability and/or fines;

- Post or share Content that is or may be illegal or inappropriate, including material that may be defamatory, obscene, harassing, offensive, fraudulent, objectionable or infringing;

- Transmit any virus, trojan horse, or other disruptive or harmful software or data;

- Send any unsolicited or unauthorized advertising, such as spam;

- Impersonate or misrepresent your affiliation with Intuit;

- Reproduce, modify, resell, license, or provide free or unauthorized access to the Platform or make the Platform available on any file-sharing, virtual desktop or application hosting service;

- Attempt to reverse engineer, decompile or disassemble in any way any of the Platform;

- Engage in unauthorized access, monitoring, interference with, or use of the Platform or third party accounts, information (including personal information), computers, systems or networks, including scraping or downloading content that doesn’t belong to you;

- Use the Platform for general archiving or back-up purposes; or

- Encourage or enable any other individual to do any of the above or otherwise violate this Agreement.

We take copyright seriously at Intuit. We respect the copyrights of others and expect you to do the same. If you repeatedly infringe the copyrights of others, we may terminate your account.

Intuit may terminate your use of the Platform based on our reasonable suspicion that your activities, business or products are objectionable or promote, support or engage in any of the prohibited uses described above.

Intuit may (but has no obligation to) monitor the use of the Platform or Content and may edit or remove any Content. We may disclose any information necessary to satisfy our legal obligations, protect Intuit or its customers, or operate the Platform properly.

Community Forums; Feedback

You may be able to communicate with others through our Platform but please be respectful. Suggestions you provide for improving our Platform may be used freely by us.

The Platform may include a community forum or other social features that enable you to exchange Content and information with other users of the Platform and the public. Intuit does not support and is not responsible for the Content in these community forums. Please be respectful when you interact with other users. Do not reveal information that you do not want to make public. Users may post hypertext links to content of third parties for which Intuit is not responsible.

You may provide Intuit your feedback, suggestions, or ideas for the Platform. You grant Intuit a perpetual, worldwide, fully transferable, sublicensable, irrevocable, fully paid-up, royalty-free license to use your feedback, suggestions, and ideas in any way, including in future modifications of the Platform, other products or services, advertising or marketing materials.

Termination

You may cancel your account and Intuit may suspend or terminate your use of the Platform. For mobile apps, removing the app may not cancel your subscription or delete your data.

This Agreement is effective until your subscription expires or you cancel your account or Intuit terminates this Agreement (or your account). Intuit may terminate this Agreement (and your account) or suspend the Platform at any time in our discretion.

Please note that removing an Intuit mobile app from your device may not cancel your subscription or delete your data. If you want to cancel your subscription for a Service, please follow the applicable Service instructions. If you wish to delete your data from a Service, please log into One Intuit Account Manager and follow the instructions under the respective data and privacy settings or follow the instructions in our Global Privacy Statement.

Effect of Termination

You must stop using the Platform once your subscription expires or you cancel your account (or if this Agreement or your account is terminated).

Upon expiration of your subscription or cancellation of your account, or Intuit’s termination of your account or this Agreement, you must immediately stop using the Platform and pay all fees due for Platform use. No expiration or termination will affect your obligation to pay all fees due or that may have accrued through the effective date of expiration or termination or entitle you to any refund.

Survival

There are a few parts of this Agreement that will continue to apply after termination. The following Sections will survive any termination, discontinuation or cancellation of the Platform or your account: “Your Personal Information,” “Payment and Cancellations” (with respect to fees due and unpaid), “Content and Data,” “Community Forums; Feedback,” “Effect of Termination,” “Disclaimers,” “Limitation of Liability,” “Indemnity Obligations,” “Disputes,” and “General Terms (Miscellaneous)”.

Intuit Communications

We may contact you from time to time to support your use of the Platform.

In order to properly support and serve you, we occasionally need to reach out and contact you, and may do so in a variety of ways such as via text message, email or messaging functionality in the Platform. We want to provide you options for receiving communications from us, and as such you may opt-in or opt-out of receiving certain types of communications from us or sign up to receive certain kinds of messages from us, depending on the Platform. You will need to notify us of any changes to your contact details to ensure your preferences are updated.

Third Party Account Information

Intuit is not responsible for any account information obtained from third parties.

When you direct Intuit to retrieve your account information from third parties, you grant Intuit a limited power of attorney to access the third-party services to retrieve such account information. Intuit will be acting as your agent and will not be acting on behalf of the third party.

Intuit does not review third-party account information for accuracy and is not responsible for any issues or expenses resulting from such account information, including any inaccuracy, error, delay, or non-delivery. For clarity, Intuit is not responsible for any payment processing errors or fees arising from inaccurate account information provided by third parties.

Disclaimers

We don’t make any warranties about the Platform except as expressly stated in this Agreement.

The only warranties we make about the Platform are (1) stated in this Agreement, or (2) as provided under applicable laws. The Platform is otherwise provided “as-is,” and we do not make any other warranties about the Platform. Unless required by law, we do not provide implied warranties, such as the implied warranties of merchantability, fitness for a particular purpose, or non-infringement. We do not warrant that the Platform is error-free, secure, or free from any viruses or other harmful components. We also do not provide any warranties with respect to data loss or to the accuracy, reliability, or availability of the Platform, nor of any content (including any Content) or information made available in the Platform. If the exclusions for implied warranties do not apply to you, any implied warranties are limited to sixty (60) days from the date of purchase or delivery of the Platform, whichever is sooner.

Limitation of Liability

Our liability is limited when it comes to issues you may encounter with our Platform.

Other than the rights and responsibilities described in this Agreement and as allowed by applicable law, Intuit won’t be responsible for any losses.

The total aggregate liability of Intuit and our third party providers, licensors, distributors or suppliers (“Intuit Parties”) arising out of or relating to this Agreement is limited to the greater of: (1) the fees that you paid to use the relevant Service(s) in the 12 months before the breach or (2) $100.

The Intuit Parties won’t be responsible for the following:

- Loss of data, profits, revenues, business opportunities, goodwill or anticipated savings;

- Indirect, incidental, or consequential loss; or

- Punitive damages.

The above limitations apply even if the Intuit Parties have been advised of the possibility of such damages. This Agreement sets forth your exclusive remedy with respect to the Platform and its use.

If you’re legally exempt from certain responsibilities, including indemnification, then those responsibilities don’t apply to you under this Agreement. For example, the United Nations enjoys certain immunities from legal obligations and this Agreement doesn’t override those immunities.

Indemnity Obligations

If someone sues us because you used the Platform unlawfully or didn’t follow our rules, you will be responsible for any harm to us.

You will indemnify and hold harmless the Intuit Parties for any losses, damages, judgments, fines, costs and expenses (including legal fees) in connection with any claims arising out of or relating to your unlawful or unauthorized use of the Platform or violation of this Agreement. Intuit reserves the right, in its sole discretion and at its own expense, to assume the exclusive defense and control of any claims. You agree to reasonably cooperate as requested by Intuit in the defense of any claims.

Disputes

In the event we are unable to resolve any dispute through an informal dialogue, a third-party arbitrator or small claims court will help us resolve any disputes we might have, and any disputes will be resolved on an individual basis rather than as a class action.

If you are a U.S. customer:

You and Intuit agree that, except as provided below, any dispute, claim or controversy arising out of or relating in any way to the Platform or this Agreement (a “Claim”) will be determined by binding arbitration or small claims court, instead of in courts of general jurisdiction.

Either you or Intuit can seek to have a Claim resolved in small claims court if all the requirements of the small claims court are satisfied. Either you or Intuit may seek to have a Claim resolved in small claims court in your county of residence or the small claims court in closest proximity to your residence, and you may also bring a claim in small claims court in the Superior Court of California, County of Santa Clara.

Arbitration is more informal than a lawsuit in court. Arbitration uses a neutral arbitrator instead of a judge or jury, may allow for more limited discovery than in court, and is subject to very limited review by courts. Arbitrators can award the same damages and relief that a court can award. You agree that the U.S. Federal Arbitration Act governs the interpretation and enforcement of this arbitration provision, and that you and Intuit are each waiving the right to a trial by jury or to participate in a class action. This arbitration provision shall survive termination of this Agreement and/or the termination of your account.

If you elect to seek arbitration, you must first send to Intuit a written notice of your Claim (“Notice of Claim”). The Notice of Claim to Intuit should be sent in care of our registered agent Corporation Service Company, 251 Little Falls Drive, Wilmington, DE 19808. The Notice of Claim should include both the mailing address and email address you would like Intuit to use to contact you. If Intuit elects to seek arbitration, it will send, by certified mail, a written Notice of Claim to your address on file. A Notice of Claim, whether sent by you or by Intuit, must (a) describe the nature and basis of the Claim or dispute; and (b) set forth the specific amount of damages or other relief sought.

You and Intuit agree that good-faith informal efforts to resolve disputes often can result in a prompt, low-cost and mutually beneficial outcome. You and Intuit therefore agree that, after a Notice of Claim is sent but before either you or Intuit commence arbitration or file a Claim in small claims court against the other, we will personally meet, via telephone or videoconference, in a good-faith effort to confer with each other and try to resolve informally any Claim covered by this Agreement. If you are represented by counsel, your counsel may participate in the conference as well, but you agree to fully participate in the conference. Likewise, if Intuit is represented by counsel, its counsel may participate in the conference as well, but Intuit agrees to have a company representative fully participate in the conference. The statute of limitations and any filing fee deadlines shall be tolled while the parties engage in the informal dispute resolution process required by this paragraph.

If we do not reach an agreement to resolve the Claim within sixty (60) days after the Notice of Claim is received, you or Intuit may commence an arbitration proceeding by filing a Demand for Arbitration or, alternatively, by filing a Claim in small claims court. You agree that you may not commence any arbitration or file a Claim in small claims court unless you and Intuit are unable to resolve the Claim within sixty (60) days after we receive your completed Notice of Claim and you have made a good faith effort to resolve your claim directly with Intuit during that time. If a Claim qualifies for small claims court, but a party commences an arbitration proceeding, you and Intuit agree that either party may elect instead to have the Claim resolved in small claims court, and upon written notice of a party’s election, the American Arbitration Association (“AAA”) will administratively close the arbitration proceeding. Any dispute about whether a Claim qualifies for small claims court shall be resolved by that court, not by an arbitrator. In the event of any such dispute, the arbitration proceeding shall remain closed unless and until a decision by the small claims court that the Claim should proceed in arbitration. You may download or copy a form of notice and a form to initiate arbitration at www.adr.org or by calling 1-800-778-7879. The arbitration will be conducted by the AAA before a single AAA arbitrator under the AAA’s rules, which are available at www.adr.org or by calling 1-800-778-7879, except as modified by this Agreement. Unless Intuit and you agree otherwise, any arbitration hearings will take place in the county (or parish) of either your residence or of the mailing address you provided in your Notice of Claim.

The arbitrator will be either (1) a retired judge or (2) an attorney specifically licensed to practice law in the state of California or the state of your residence and will be selected by the parties from the AAA’s National Roster of Arbitrators. The arbitrator will be selected using the following procedure: (a) the AAA will send the parties a list of five candidates meeting this criteria; (b) if the parties cannot agree on an arbitrator from the list, each party shall return its list to the AAA within 10 days, striking up to two candidates, and ranking the remaining candidates in order of preference; (c) the AAA shall appoint as arbitrator the candidate with the highest aggregate ranking; and (d) if for any reason the appointment cannot be made according to this procedure, the AAA may exercise its discretion in appointing the arbitrator. The arbitrator is bound by this Agreement. Except as otherwise provided below, all issues are for the arbitrator to decide, including issues relating to the scope and enforceability of this arbitration provision.

The parties agree that an administrative conference with the AAA shall be conducted in each arbitration proceeding, and you and an Intuit company representative shall appear at the administrative conference via telephone. If you fail to appear at the administrative conference, regardless of whether your counsel attends, the AAA will administratively close the arbitration proceeding without prejudice, unless you show good cause as to why you were not able to attend the conference.

The arbitrator shall issue a reasoned written decision sufficient to explain the essential findings and conclusions on which the award is based. The award shall be binding only among the parties and shall have no preclusive effect in any other arbitration or other proceeding involving a different party. Intuit will not seek to recover its attorneys’ fees and costs in arbitration from you unless the arbitrator finds that either the substance of your Claim or the relief sought in your Demand for Arbitration was frivolous or was brought for an improper purpose (as measured by the standards set forth in Federal Rule of Civil Procedure 11(b)). Judgment on any award may be entered in any court having jurisdiction. This agreement to arbitrate shall not preclude any party to the arbitration from at any time seeking injunctions or other forms of equitable relief in aid of arbitration from a court of appropriate jurisdiction including whether a Demand for Arbitration is filed in violation of this Agreement.

Unless you or Intuit seek to have a Claim resolved in small claims court, the arbitrator shall determine all issues of liability on the merits of any Claim asserted by you or Intuit and may award declaratory or injunctive relief only in favor of the individual party seeking relief and only to the extent necessary to provide relief warranted by that party’s individual claim. To the extent that you or Intuit prevail on a Claim and seek public injunctive relief (that is, injunctive relief that has the primary purpose and effect of prohibiting unlawful acts that threaten future injury to the public), the entitlement to and extent of such relief must be litigated in a civil court of competent jurisdiction and not in arbitration. The parties agree that litigation of any issues of public injunctive relief shall be stayed pending the outcome of the merits of any individual Claims in arbitration. Before a court of competent jurisdiction issues any public injunctive relief, it shall review the factual findings of the arbitration award on which any injunction would issue with no deference to the arbitrator.

Payment of all filing, administration and arbitrator fees will be governed by the AAA Rules. You are required to pay AAA’s initial filing fee, but Intuit will reimburse you for this filing fee at the conclusion of the arbitration to the extent it exceeds the fee for filing a complaint in a federal or state court in your county of residence or in Santa Clara County, California. If the arbitrator finds that either the substance of your Claim or the relief sought in your Demand for Arbitration was frivolous or was brought for an improper purpose (as measured by the standards set forth in Federal Rule of Civil Procedure 11(b)), then the payment of all fees will be governed by the AAA Rules and Intuit will not reimburse your initial filing fee. The parties agree that the AAA has discretion to modify the amount or timing of any administrative or arbitration fees due under the AAA Rules where it deems appropriate, provided that such modification does not increase the AAA fees to you or Intuit, and you and Intuit waive any objection to such fee modification.

You and Intuit agree that each may bring Claims against the other only in your or its individual capacity, and not as a plaintiff or class member in any purported class or representative proceeding. Further, if you have elected arbitration, unless both you and Intuit agree otherwise, the arbitrator may not consolidate any other person’s Claims with your Claims and may not otherwise preside over any form of a representative or class proceeding. If Intuit believes that any Claim you have filed in arbitration or in court is inconsistent with the limitations in this paragraph, then you agree that Intuit may seek an order from a court determining whether your Claim is within the scope of the Class Action Waiver. If this Class Action Waiver is found to be unenforceable, then the entirety of this Disputes Section shall be null and void.

General Terms (Miscellaneous)

Governing Law

The laws of California govern this Agreement and any disputes that may arise.

California law and the Federal Arbitration Act will govern all disputes arising out of or relating to the Platform, this Agreement and any Additional Terms, regardless of conflict of laws rules.

Global Trade and Export Restrictions

You are allowed to use the Platform under the laws of the U.S. and other applicable territories. The Platform shall not be exported to countries that are embargoed by the U.S. government.

You agree that you and anyone who uses the Platform, including the related website, online services and mobile apps, are not prohibited from using the Platform under the laws and regulations of the United States or other applicable jurisdiction. For example, you are not on the U.S. Treasury Department’s list of Specially Designated Nationals or any other similar prohibition. You acknowledge that the Platform may be subject to restrictions under applicable U.S. export control laws and regulations. You agree that you will comply with these export control and sanctions laws and regulations, and will not transfer or provide any part of the Platform, in violation of these laws and regulations, directly or indirectly.

Government End Users of Software

Even if you are a government end user, your rights to Software are limited to what is described in this Agreement.

The Software is a “commercial item” as that term is defined in FAR 2.101, consisting of “commercial computer software,” as such term is used in FAR 12.212 and DFARS 227.7202. If the Software is being acquired by or on behalf of the U.S. Government, then, as provided in FAR 12.212 and DFARS 227.7202-1 through 227.7202-4, as applicable, the U.S. Government’s rights in the Software will be only those specified in this Agreement.

Waiver

If we waive some of our rights under this Agreement, it doesn’t mean we waive our rights in other circumstances.

Intuit’s failure to act or enforce any of its rights does not constitute a waiver of any of our rights. Any waiver by Intuit of any of the provisions in the Agreement must be made in writing and signed by a duly authorized officer of Intuit.

Assignment

You can’t transfer this Agreement or your right to use the Platform to someone else without our permission.

Intuit may assign this Agreement to any party at any time without notice to you. You may not assign your rights under this Agreement, by operation of law or otherwise, without our consent. Any attempts to do so without our consent will be void.

Severability

If a court voids a term of this Agreement, the other terms will not be affected.

If any provision of this Agreement is unlawful, void, or unenforceable for any reason, then that provision will be severed and the remaining provisions will remain in full force and effect.

Contact Information

If you have any questions about the Platform or this Agreement, please contact Intuit support.

Latest Revision: August, 2023

______________________

Section B

ADDITIONAL TERMS AND CONDITIONS FOR INTUIT QUICKBOOKS DESKTOP SOFTWARE

IMPORTANT NOTICE. USE LIMITATIONS: Your rights to use the Software, Services, add-on products and services (if any) are subject to the general terms above and the Additional Terms and Conditions below. The Additional Terms and Conditions BELOW shall prevail over any conflict or inconsistency with the General terms above.

1. DEFINITIONS. For purposes of this Section B, certain capitalized words and phrases used in this Section have the meaning defined below. Other capitalized terms and their defined meaning are also provided embedded elsewhere within the text of this Agreement.

1.1. “Applications” means Intuit Applications and Third-Party Applications.

1.2. “Authorized User(s)” means any and all individuals (e.g., your accountant or trusted financial advisor, etc.) who you designate or authorize to access and/or modify your Software data on your behalf.

1.3. “Beta Features” means any new or updated non-commercially available Software features which Intuit may from time to time make available for your use, Trial, and feedback.

1.4. “Data Transfer” means the process of transferring or sharing, upon your authorization, your Software data with or to one or more Applications.

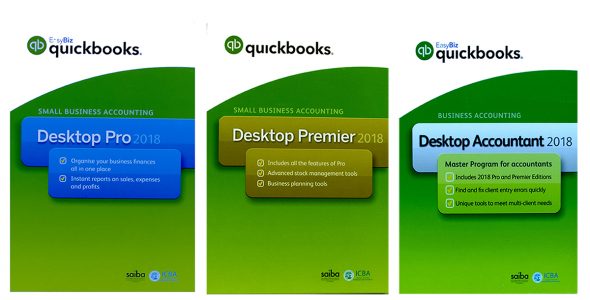

1.5. “Desktop” is used to refer to any and all versions or editions of QuickBooks primarily designed for installation, access and use on a desktop or laptop computer (e.g., QuickBooks Desktop Pro Plus, or QuickBooks Desktop Premier Plus, Accountant, Mac Plus, Enterprise, etc.).

1.6. “Intuit Application(s)” means other, separate applications developed by Intuit that you use and/or authorize to access your Software data using the Data Transfer features.

1.7. “QuickBooks Online” or “QBO” is used to refer to the version of QuickBooks primarily designed for access and use as an online-hosted Service.

1.8. “QuickBooks” or “QuickBooks Desktop” means the 2024 Intuit QuickBooks Desktop financial and accounting software application.

1.9. “Service(s)” is used in this Section B to refer to the various systems, facilitative processing operations, functionality, or other operational features, including but not limited to support and maintenance, or other products or promotions which may be provided or made accessible to you in or through the Software as a standalone or online-hosted offering. Services does not include paid add-on services that may be available to you for a separate or additional fee through the Software.

1.10. “Software” has the meaning defined above in Section A and for purposes of this Section B means specifically the QuickBooks Desktop software for 2024 that is the object of this Agreement, as well as any other free Intuit-provided Services, software, applications, programs, tools, and other components, accessible in or through, or in combination with, QuickBooks Desktop, including but not limited to the QuickBooks Desktop Manager installer application (if provided to you) and any QuickBooks Desktop Mobile Application(s) for iOS and/or Android mobile operating systems, if available for use with your version of QuickBooks Desktop, as well as any Updates that you may be eligible to receive based on the Subscription license purchased as set forth in Section 10 further below. For clarity, Software excludes Upgrades and any paid add-on services, such as Payroll for Desktop, other Ancillary Payment Services and Money Movement services.

1.11. “Subscription” or “Subscription Plan” refers to the payment of fees on a monthly, quarterly, or annual basis for a license to access and use the Software and any included Services.

1.12. “Third Party Application(s)” means each and all products or services developed by third parties that you use in or through the Software and/or authorize to access your Software data.

1.13. “Trial” means a limited trial-only version of the Software, along with any add-on or other software, products, services, functionality, or features, which may be offered by Intuit for your use on a limited or short-term basis.

1.14 “Uninstall” and “Install” as used throughout this Agreement refer to the actual removal of QuickBooks application from a computer (Uninstall) and the reinstallation (Install) of a new version of the QuickBooks software, along with the upgrades of all QuickBooks related data and company files.

1.15. “Updates” means Software improvements, patches, security updates, fixes, (including, e.g., security fixes or bug fixes), changes, including addition or removal of new or existing features, new required processes or steps, other components, error corrections, or other requirements for continued use of the Software, generally provided to users of your specific version of the Software, when-and-if they are made available and as may be required by Intuit for continued use of the Software. For clarity, Updates exclude Upgrades.

1.16. “Upgrades” means any major or significant future-released versions of the full or complete Software, if developed and released by Intuit at its sole discretion. Intuit may choose not to release any Upgrade of the Software during or after your current Subscription term. For clarity, Upgrades exclude Updates.

1.17. “You”, “you” and “your” as used throughout this Agreement means the individual person, or the legal entity on whose behalf such person acts, that licenses the Software and is identified by name during the Software account creation and registration process.

2. REGISTERING THE SOFTWARE; ACCOUNT SIGN UP OR SIGN-IN; REGISTRATION DATA

2.1. Registering the Software. During or after installation, you will be required to activate and register the Software (including providing your company information and the personal information of an authorized company representative) before use. You will be asked to provide a valid Software product and/or license number or key. You agree to keep your registration and/or account profile information accurate, complete, and current and any Software license information secure and confidential. Allowing or enabling others to use your license number(s), product number(s), and validation number(s), if any, is a violation of this Agreement, grounds for immediate termination by Intuit and is strictly prohibited.

2.2. Intuit Account Creation and Sign Up or Sign In. You will be required to create or sign up for an Intuit account (and sign in) with Intuit in order to use the Software and you agree to do so within the time specified by the Software, otherwise you will not be able to continue to use the Software. To help avoid unintended access to your account or profile information, the Software may be designed to automatically sign you out of your account (and require another sign in), including after periods of inactivity. When signing up or using the Software, you may be prompted to create a (one-time) private encryption key or password in connection with your account and data file(s), and you may be required to engage in multi-factor authentication, including via use of a unique security code sent to your mobile device. You understand and agree that you are responsible for any and all mobile data charges associated with this multi-factor authentication. Once created, you must take care to either memorize and/or securely store all passwords and encryption keys. If you forget or misplace an encryption key, you may lose access to your data that is encrypted with that key. Intuit is not responsible or liable for passwords or encryption keys stored insecurely, forgotten, or misplaced, or for any unauthorized access or inability to retrieve or recover access to data resulting from such unsecured, forgotten, or misplaced passwords or encryption keys.

2.3. Registration Data. Your data, including your registration information, will be collected and used as provided in this Agreement and in accordance with our privacy policies, which can be found at https://security.intuit.com/index.php/privacy or by accessing the Privacy link on the website for the Software. If and when you connect to the internet and use the Software, Intuit may also gather certain kinds of information which Intuit may use to improve the Software and/or develop other Intuit products, better customize your experience with the Software in future releases, and present you with improved Intuit marketing offers.

3. LICENSES, LICENSE GRANT; LIMITATIONS AND RESTRICTIONS

3.1. Licenses, License Grant. Provided that you comply with all of the terms and conditions of this Agreement, Intuit grants you the following license rights:

3.1.1. Trial-User License. From time to time, Intuit or certain third parties may offer certain Trials and the opportunity to use them for a finite period of time (“Trial Period”). If you have signed up to use any Trial version or Trial Subscription in the United States:

3.1.1.1. You are granted a limited non-exclusive license during the Trial Period to use the Trial so that 1 individual may access the Trial version or Subscription on a single computer. You may print 1 copy of any online user documentation in relation to the Trial version or Subscription, however, you cannot make multiple copies of any online user documentation or printed materials that accompany the Trial (if any); and

3.1.1.2. Your license to use any Trial is valid only for the Trial Period. You understand that upon expiration of your Trial user license, you must purchase a license for the particular software, product, or Service or sign up for the Subscription in order to continue using or accessing the applicable software, product, or Service and to retain any Content (defined furthest above in Section A.5.) that you have entered into or created within the software, product, or Service data file, or posted or uploaded during the Trial Period. If you do not purchase the particular software, product, or Service license or Subscription by the end of the Trial Period, your Content will no longer be available to you. To be very clear, after using the Trial software, product, or Services during the Trial Period, if you decide not to purchase the license or Subscription for the full version of the applicable software, product, or Services, you will not be able to access or retrieve any of the Content and data you added, uploaded, or created with the Trial during the Trial Period.

3.1.2. Subscription License. If you purchased a Subscription, the terms of this Agreement, as supplemented by Intuit’s then-current Subscription terms, will govern your use of the Software. The duration of such license to use the Software will be based on your product’s then current Agreement, and your timely payment of all subscription renewal costs and fees.

3.1.3. Single User License and Single User Add-On Pack Licenses. If you purchased a single user Subscription license you may install the Software for access and use solely by one specific person on (i) one primary computer, and (ii) one additional computer (e.g., a laptop or a home computer) –-and, for the QuickBooks Desktop Mobile App, on your mobile device(s)–- which together you own and use in your business, all for use by that same specific individual person, all of the duration of your paid Subscription term.

3.1.4. Multi-User License and Multi-User Add-On Pack Licenses

Certain versions of the Software or Subscription may allow for multiple additional users of the specific edition of the Software you have Subscribed to use, if applicable, upon payment of an additional license fee for each such additional user. If you purchased a multi-user Subscription license or add-on pack you may install the Software on the number of computers equal to the number of user licenses for which you purchased Subscriptions — or, for the QuickBooks Desktop Mobile App, on your mobile device(s), all for the duration of your paid Subscription term.

You understand and agree that access to and use of the Software is solely for the number of specific persons corresponding to the number of user Subscription licenses you purchased, with no substitution of such users except as expressly permitted by this Section. By way of example only, if you have 10 employees in your company, and if you have only paid for 3 user Subscription licenses for your specific edition of the Software, you are granted a limited non-exclusive license to: download and install the Software on up to 3 computers which are owned and operated by and for your company; and allow up to 3 individuals only (who are your owners, employees, or contractors) access the Software or Subscription during the paid Subscription term. You may also: (a) place a copy of your Software data file(s) on a network to be accessed and used by such individuals (and install the Software on one additional computer above the number of the license(s) you purchased, solely to accompany your Software’s shared data file, and not for direct use of the Software by another user); and (b) for each user license you purchased, make one copy of the printed materials accompanying the Software, if any, or print one copy of any online user documentation provided in relation to the Software, solely for use by such licensed user, all solely during the paid Subscription term. If a licensed user is no longer employed by your company, you may reassign that employee’s user license to another user within your company (i.e., designate a new specific employee to use the license formerly used by the departed employee). All users in a multi-user environment must be using licensed copies of the same version year of the Software. Use of the Software by each additional user will be subject to the same restrictions as the single user license. You are responsible for ensuring that all licensed users, including any added licensed users, comply fully with the terms of this license.

3.1.5. Use with Your Mobile Device. Use of the Software may be available through a compatible mobile device and require Internet access. You agree that you are solely responsible for these requirements, including any applicable changes, updates and fees as well as the terms of your agreement with your mobile device and telecommunications provider.

INTUIT MAKES NO WARRANTIES OR REPRESENTATIONS OF ANY KIND, EXPRESS, STATUTORY OR IMPLIED AS TO:

(a) THE AVAILABILITY OF TELECOMMUNICATION SERVICES FROM YOUR PROVIDER AND ACCESS TO THE SERVICES AT ANY TIME OR FROM ANY LOCATION;

(b) ANY LOSS, DAMAGE, OR OTHER SECURITY INTRUSION OF THE TELECOMMUNICATION SERVICES; AND

(c) ANY DISCLOSURE OF INFORMATION TO THIRD PARTIES OR FAILURE TO TRANSMIT ANY DATA, COMMUNICATIONS OR SETTINGS CONNECTED WITH THE SERVICES.

3.1.6. Unlocking a New Software License. If you elect to convert from one edition of the Software to another using the unlock purchase process within the Software, your use of the new unlocked version or edition of the Software must be in accordance with the terms and conditions of this Agreement. Once you have the unlocked version, you may no longer use the original version of the Software on any computer.

3.1.7. Software Copies. Whichever license you obtain, if you purchased a valid Subscription license for the Software and received the Software through an electronic download, you may make one backup copy of the Software, but only for the purpose of reinstalling the Software for your own use, if needed, on the single computer or additional computer referenced in 3.1.2., and 3.1.3., above. You are not allowed to make copies of the printed materials accompanying the Software, if any, or print multiple copies of any user documentation.

3.1.8. License Grant for Payroll for Desktop (if purchased, subscribed and activated). If you purchase a subscription for Payroll for Desktop services to use with the Software, then:

3.1.8.1. If and when you subscribe to the Payroll for Desktop service, accept any additional terms, and pay the applicable subscription fee, Intuit grants you a limited non-exclusive license to use the tax tables, selected payroll tax forms (for Standard and Enhanced Payroll for Desktop services only) and applicable updates, when-and-if made available to you, as well as related documentation within the United States, only in connection with the Software and Payroll for Desktop services, and only provided that you comply with all of the terms and conditions of this Agreement. You may only use and/or install the Payroll for Desktop service and Updates, including tax table Updates, only on the computer(s), and only for access and use by the individual(s) or entity, for which the Software license was purchased; and

3.1.8.2. You may not perform any of the following actions which are violations of this Agreement and the licenses granted to you: (i) Use Payroll for Desktop service Updates except with the Software; (ii) distribute copies of the Software, or allow access to the Payroll for Desktop service, to or by entities or persons that have not purchased a license to the Software or Payroll for Desktop service from Intuit; (iii) permit others to access the Payroll for Desktop service for their own purpose, or (iv) process payroll, make payments or otherwise use the Money Movement Services (as described and defined in Section 5.1) for any other person, company, or legal entity without a valid license or subscription to the applicable Payroll for Desktop service for Accountants.

3.1.9. Assisted Payroll for Desktop. If you purchase a subscription for Assisted Payroll for Desktop services (defined in Section 5.3 below), then, as long as you pay the applicable fees and accept any additional terms presented during the purchase process, Intuit grants you a limited non-exclusive license to use the tax tables, selected payroll tax forms, when-and-if available, and documentation within the United States, provided that you comply with all of the terms and conditions of this Agreement and any other terms presented during sign-up. You may only use or install Updates to the Assisted Payroll for Desktop service on the computer(s) used by the individual(s) for whom you have purchased a license to the Software.

4. MAXIMUM LIMITS FOR SIMULTANEOUS USERS; CONCURRENT FILE ACCESS; LIST ENTRIES

4.1. Maximum Limits for Simultaneous Users. Subject to the terms of this Agreement, the particular edition of the Software licensed, and the number of individual user licenses paid for by you as described above in Section 3.1.3., you may be permitted a multiple number of licensed users who are authorized to simultaneously access and use the Software (or concurrently access a company file) on a network, up to a maximum number of licensed users as set forth in the table below. Any unauthorized use of the Software (or concurrent access of a company file) by more than the maximum number of simultaneous (or concurrent) licensed users permitted for that particular version of the Software, or otherwise exceeding your paid license(s), may result in failure of the Software, performance degradation, errors, and/or loss of data, and will be considered a material breach of this Agreement:

| Software Edition | Maximum Number of Concurrent Users (subject to paid additional user licenses) |

| QuickBooks Desktop Pro Plus | up to 3 |

| QuickBooks Desktop Premier Plus | up to 5 |

| QuickBooks Accountant Desktop (Subscription) | up to 5 |

| QuickBooks Accountant Enterprise | up to 30 |

| QuickBooks Desktop Enterprise | up to 40 depending on desktop version subscribed |

4.2. Maximum Limits for Concurrent File Access. When you purchase a Software license, you may be able to use the Software to manage multiple (different) company files. Depending on the edition of the Software, type and number of user licenses you purchase (for example, Software versions or licenses that allow for multiple users or multiple user mode), and subject to your payment of applicable additional or multi-user license fee(s), 2 or more networked users may be able to open, manage, and/or collaborate on the same company file at the same time. As set forth above in Section 4.1., there may be limits to the number of concurrent networked users who may simultaneously access any single company file. Additionally, if you have not acquired sufficient user licenses the Software may not support or allow the opening or managing of different company files simultaneously. You are responsible for all access and use (and for maintaining password protection) of all your company data files.

4.3. Maximum Limits for List Entries. When you purchase a Software license, and depending on the particular Software edition and operating system platform (Windows or Mac), there may be limits to the number of lists, list entries, and custom fields permitted for each list in your company data file based on your version of the Software. See the Software website, or packaging or installation guide for more information. Within the Software, you can also press the F2 key to display certain product information, including the version of QuickBooks Desktop Software you are running, the size and location of your company file, and the number of lists or number of entries you have in your lists.

5. ADDITIONAL LICENSES AND SERVICES AVAILABLE BY SUBSCRIPTION. Additional Subscription licenses and services that may be obtained in connection with the Software include the following:

5.1. Money Movement.

5.1.1. Intuit Payments Inc. Intuit and its subsidiaries and/or affiliates offer add-on fee-based services that include payments functionality that you can obtain in connection with your use of the Software (the “Ancillary Payments Services”). The Ancillary Payments Services, as further defined and described below, are the following additional subscription services that may be obtained in connection with the Software: Payroll for Desktop service(s); Assisted Payroll; Enhanced Payroll and Direct Deposit Service(s) or successor versions of such services. To the extent that your use of the Ancillary Payments Services involves the transmission of funds, whether in connection with payroll processing, tax payments, or other similar payments-related services (collectively, “Money Movement” services”) such Money Movement services are provided to you by Intuit Payments Inc. (“IPI”), a licensed money transmitter. Please note that while the Money Movement services are provided by IPI, under certain circumstances IPI is not required to provide such services under its money transmission licenses. All references in this Agreement to “Intuit,” “we,” “us,” “our,” or similar terms, shall be understood to mean IPI solely with respect to the provision of Money Movement services. For payment processing services for merchants, please see Section 6.11 below.

5.1.2. General Conditions for Money Movement Services.

5.1.2.1. The Money Movement services are available only in the United States (but not the U.S. Virgin Islands, Puerto Rico, and other U.S. territories and possessions). To be able to use the Money Movement Services, you: must not be domiciled, reside, or have a principal place of business outside the United States; must not be engaged in any illegal activity or any activity reasonably likely to cause notoriety, harm, or damage to the reputation of Intuit, IPI or any banks or other service providers we use to provide the Money Movement Services; must not be listed on any other third party or governmental sanctions lists; and must comply with the Acceptable Use Policy. If you are engaged in any of the prohibited activities, business types, or transactions described in our Acceptable Use Policy, you are not eligible (or may become ineligible) to use the Money Movement Services. In addition, you may not, and may not attempt to use the Money Movement Services to transfer funds to a person, entity, or jurisdiction outside of the United States or in any instance in which such transactions are prohibited by law, nor may you use the Money Movement Services for any funds transfers not part of the Ancillary Payments Services. If there are multiple licensed Software users, you affirm that each user of the Money Movement Services who initiates a payment request is authorized to do so on your behalf.

5.1.2.2. From time to time, IPI may publish additional guidelines, policies, and rules (collectively “IPI Policies”) regarding the Money Movement Services and will provide appropriate notice to you regarding such IPI Policies. Consistent with any such notice provided to you, you understand and agree that your use of the Money Movement Services must be consistent with such IPI Policies, and agree to provide any information we deem necessary to verify your compliance with such IPI Policies.

5.1.2.3. In order to comply with applicable federal laws relating to anti-money laundering and terrorism financing, including the USA PATRIOT Act and the Bank Secrecy Act, IPI may request that you provide information beyond what is required for your use of the Software, including but not limited to: a copy of a government-issued ID (such as a passport or driver’s license); your business license; taxpayer ID number; financial or bank statements; utility bills; or your personal or business tax returns. In addition, you agree and authorize IPI (directly or through third parties) to make any inquiries we consider necessary to verify your or, in the case of an entity, the principals’ and/or owners’, identities, or to determine your current and ongoing creditworthiness, financial status, and/or ability to perform the obligations hereunder. This may include asking you to confirm email address, mobile/phone numbers, or bank accounts, or verifying information you have provided using third-party databases (including by obtaining your individual and business credit report, personal profile, or other information from one or more third-party databases). You consent to IPI updating your account information from time to time based on information provided by you, your bank, other payments services providers, or other data sources used to evaluate the current status of the business and/or its owners.

5.1.2.4. IPI may establish processing limits and assign a maximum dollar amount for Money Movement Services provided to you during any applicable period of time identified by IPI. Consistent with obligations under applicable state money transmission laws and federal anti-money laundering laws, IPI may, in its sole discretion, place holds on any Payments (as defined below) initiated by you in order to protect against potential risk or fraud. Reasons for holds are proprietary to IPI and Intuit and may be based on multiple factors, including, but not limited to: (i) no or limited payments processing history with Intuit; (ii) past performance or standing of your account, including return or dispute rates; or (iii) businesses offering higher risk goods or services. You understand and agree that IPI’s evaluation of risk may result in your ineligibility for some or all Money Movement Services provided in connection with the Ancillary Payments Services, including with respect to the settlement timing for Payments (subject to applicable restrictions under state money transmission laws). IPI also reserves the right, in its sole discretion, to review and reject any Payment. If a Payment is cleared after review, we will provide notice to you. Otherwise, we will attempt to cancel the Payment and your funds may be returned. IPI will have no liability for any losses, either direct or indirect, which you may attribute to any hold, review, or other delay or suspension of a Payment.

5.1.2.5. Without limiting the conditions of termination as set forth in Section 14 below, IPI reserves the right, in its sole discretion and with or without notice or cause, to suspend or terminate the provision of Money Movement Services and any/all Ancillary Payment Services, including without limitation, if: (a) we have reason to believe that fraudulent transactions or other activity prohibited by this Agreement has occurred; (b) such action is necessary to prevent loss to us; or (c) you violate any portion of this Agreement, including the Acceptable Use Policy; and (d) if Intuit decides at its sole discretion to discontinue offering or providing you with such Money Movement Services and any/all Ancillary Payment Services via the Software or (d) Intuit, IPI or any of their affiliates decide in their sole discretion, for any reason or for no reason, to discontinue offering and/or providing any such services to you at the end of your current Subscription term.

5.1.2.6. Upon termination, your ability to use the Ancillary Payments Services may be limited as we will not be able to facilitate transmissions of funds on your behalf. Any funds that remain in your account for any reason, including your abandonment of your account or your failure to remedy any deficiencies in the information we are required to collect for anti-money laundering purposes, for the applicable time period as mandated or allowed by applicable law may be remitted to your state of residency or otherwise in accordance with unclaimed property laws. We may also unwind transactions or direct funds to specially designated accounts pursuant to anti-money laundering, sanctions or other compliance requirements.

5.1.3. IPI Provision of Money Movement Services.

5.1.3.1. The Ancillary Payments Services provide functionality to enable you to track, calculate, and initiate payroll and other payments to employees, tax payments to taxing authorities, and other payments to employees or third-party vendors. Specific conditions and requirements for each of the Ancillary Payments Services is provided below. This section describes rights, responsibilities, and obligations with respect to the transmission of funds on your behalf in connection with the Money Movement Services.

5.1.3.2. With respect to the Money Movement Services, you are the “Payor” and the person or entity you are seeking to pay (which may be a vendor, taxing authority, or Employee, as defined below) is a “Payee.” As a Payor, an eligible transfer of funds to a Payee that you initiate through any of the Ancillary Payments Services, in accordance with the specific terms set forth below and any instructions provided through the applicable software, constitutes a “Payment.” When you make a valid Payment request, IPI receives funds from you and transmits the funds to the Payee in accordance with your instructions. When transferring funds IPI receives from you to a Payee, IPI’s obligation with respect to Payment shall be deemed satisfied when the Payee’s bank credits the Payee’s account with such funds.

5.1.3.3. To use the Money Movement Services and to initiate a Payment, you must have a demand deposit account with an eligible financial institution capable of enabling Automated Clearing House (“ACH”) transactions and such account must be identified when you enable the Ancillary Payments Services (“Your Account”). You can change Your Account in accordance with instructions provided through the Ancillary Payments Services settings. Please note, however, that under certain circumstances IPI reserves the right to use wire drawdown requests or other funding methods (collectively “Debits”) to fund your Payments.

5.1.3.4. You may request that IPI initiate a Payment to a Payee or Payees online (“Payment Transaction(s)”). After you submit your Payment Transaction, IPI will confirm receipt of the Payment request. Your Payment Transaction will not be processed if you do not receive our confirmation before the Payment Transaction is over. However, a confirmation does not mean that your Payment Transaction is error-free, and if errors are detected later we may be unable to complete your Payment Transaction. We will make reasonable efforts to tell you if we cannot complete your Payment Transaction. Payment Transactions taking place after certain processing deadlines may be considered to occur on the next business day. Specific information regarding Payment Transactions for applicable Ancillary Payments Services is provided in the below descriptions of the applicable service.

5.1.3.5. IPI generally processes Payment Transactions using the ACH. Such transactions are governed by the rules of the National Automated Clearing House Association (“NACHA”). NACHA may amend these NACHA Operating Rules at any time. By initiating a Payment, you authorize IPI to initiate credit and debit entries to Your Account, and to send Payments electronically or by any other commercially accepted method to the Payee or Payees you have designated and pursuant to instructions you provide with your Payment Transaction. You also authorize and direct the depository financial institution that holds Your Account to charge each debit to Your Account for that amount to be credited to IPI, and to respond to inquiries from IPI regarding your information and Your Account. This authorization will remain in full force and effect until IPI has received written notification from you of its termination in such time and in such manner as to afford IPI and the depository financial institution that holds Your Account a reasonable opportunity to act on it. For Payees that will receive disbursements via ACH, you agree to obtain the Payee’s consent to credit their bank account and initiate a disbursement over the ACH network. Such consent must be in a form and manner that complies with the NACHA Operating Rules. You also agree to maintain the security and integrity of all information that you collect and/or provide to IPI that IPI uses to process a Payment Transaction, whether using the ACH or otherwise.

5.2. QuickBooks Payroll for Desktop (Basic, Standard or Enhanced), each referred to here as, “Payroll for Desktop”)

5.2.1. Subscribing to the Payroll for Desktop. To subscribe to a subscription plan for a Payroll for Desktop service and to be able to calculate applicable payroll taxes and make payments, you must: (i) have registered the Software, (ii) have internet access, and (iii) use the latest version or Update of the Software, as required by Intuit. If applicable, you may be able to purchase a subscription for the Payroll for Desktop service online or by phone, or you may be able to subscribe from within the Software by selecting the appropriate employee menu item, and you will need to activate the Payroll for Desktop service within the Software using the numerical key provided to you at the time of subscription purchase. If you subscribe, your use of the Payroll for Desktop services shall be subject to this Agreement and in accordance with this Section (and to any subscription plan terms or other terms and conditions that accompany the Payroll for Desktop service itself). For purposes of this Agreement, the Payroll for Desktop service does not include or apply to Software and Trial versions that do not include or offer access to the applicable Payroll for Desktop service.

5.2.2. License Grant and Restrictions. For license(s) granted to you for use of the Payroll Desktop Services, see Section 3.1.8., above.

5.2.3. Activating Payroll for Desktop. The subscription for the applicable Payroll for Desktop service you purchased will begin after it is activated within the Software and after we receive and process all the information requested during sign up, including your credit card or bank account information. Any subscription for Payroll for Desktop service purchased at a physical retail store location will begin after you activate the Payroll for Desktop service subscription online, which activation must occur no later than 60 days from purchase or the date indicated on the exterior of the Software packaging, whichever is earlier.

5.2.4. Unless You Have Purchased a Software Subscription with Payroll for Desktop already Included, a separate Payroll for Desktop service subscription Is required for each registered copy of Software. Unless you purchased a desktop Software bundle or Subscription with payroll already included (i.e., QuickBooks Desktop Pro + Payroll for Desktop), then for each registered copy of the Software, you must purchase a separate Payroll for Desktop service subscription in order to be able to use the Payroll for Desktop Service with that particular registered copy of the Software. For purposes of the Payroll for Desktop service subscription, QuickBooks Desktop Pro, QuickBooks Desktop Premier Multi-user pack, and QuickBooks Desktop Enterprise Solutions Business Management user pack are each considered a single registered copy of the Software. If you are using one of the aforementioned versions of the Software, you will need only one subscription to the applicable Payroll for Desktop service. For every Payroll for Desktop service subscription, Intuit may impose a limit on the number of employer identification numbers (EINs) for or with which you can use the Payroll for Desktop service and if you exceed this limit, you may be required to pay additional fees.

5.2.5. Payroll Tax Table Updates

5.2.5.1. Updates to payroll tax tables may be provided, when-and-if they are made available by Intuit in its sole discretion, to active subscribers to the Payroll for Desktop service. We strongly recommend that you connect to your applicable Payroll for Desktop service regularly to validate your subscription and to be sure you have the most currently available Payroll for Desktop service Updates, including the most current rates and calculations for supported tax tables. Failure to connect to your Payroll for Desktop service regularly may result in inaccurate withholding from payroll and you hereby assume any and all liability resulting from any such inaccurate withholding, or resulting in any way from your failure to regularly connect and update your Payroll for Desktop service. Also, as a safety measure, and due to the nature and frequency of changes in payroll tax rates, if your Payroll for Desktop service subscription expires, you will be unable to continue to process payroll using Payroll for Desktop service tax tables or tax forms, and if this occurs, you must connect to your Payroll for Desktop service, bring your subscription account current if necessary, and get the latest Payroll for Desktop service Updates in order to again be able to process payroll.

5.2.5.2. The Payroll for Desktop services may contain dated information. In using the Payroll for Desktop service, you understand that it may not include all the information or the most current information relevant to your particular needs or situation.

5.2.6. Preparation and Filing (or E-Filing and E-Payment) of Payroll Taxes and Other Liabilities